How AI Can Improve the Holiday Shopping Experience

Consumers are returning to stores to do their holiday shopping according to multiple reports. How can artificial intelligence (AI) help them have a better experience?

What the Data Says

As U.S. shoppers continue to learn how to live with the COVID-19 pandemic, they are returning to brick-and-mortar retail stores following two years of lockdowns and resurgent variants that have disrupted in-store shopping. In 2022, though, chronic inflation and lingering economic uncertainty are affecting consumers’ overall shopping habits both online and offline. Here is what the data says:

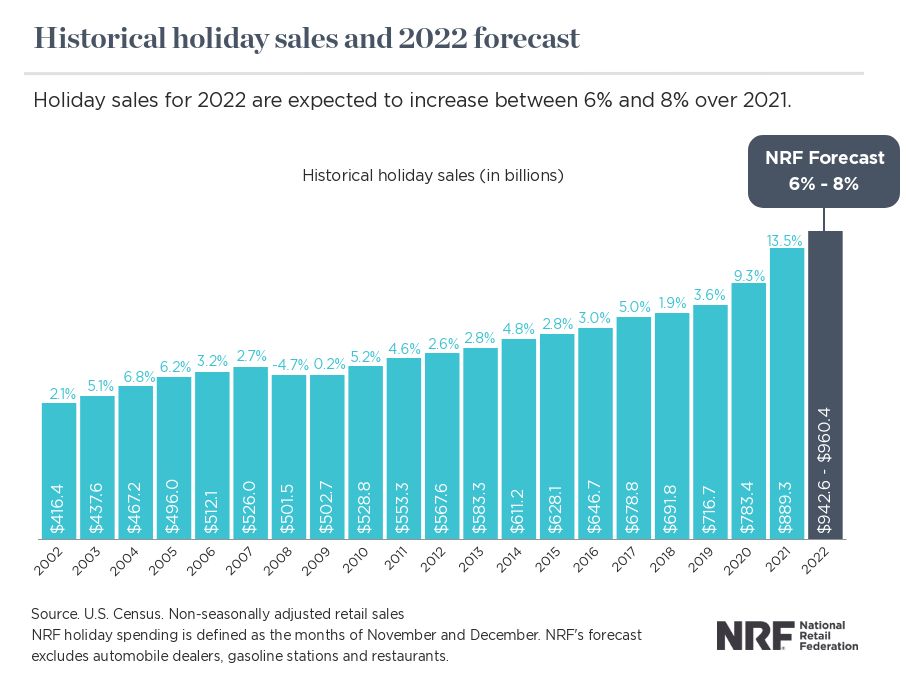

- Overall, consumers will spend more online and offline, with offline enjoying an edge in 2022, according to the National Retail Federation (NRF). The growth rate from 2021 will not be as strong as it was from 2020 to 2021, but growth is happening, nonetheless.

- Per the NRF, holiday retail sales during November and December will grow between 6% and 8% over 2021 to between $942.6 billion and $960.4 billion. Last year’s holiday sales grew 13.5% over 2020 and totaled $889.3 billion, breaking previous records.

- While eCommerce will remain important, households are also expected to shift back to in-store shopping and a more traditional holiday shopping experience, according to the NRF. In-store purchases will account for anywhere from $679.8 billion to $692.8 billion.

- Placer.ai (which provides anonymized foot traffic insights across the U.S.) and Leap (a retail platform for brands) both see in-store holiday shopping picking up steam. Leap specifically cites point-of-sale trends that support an early holiday shopping pattern. Weekend sales in mid-October last year went up nearly a third, over the first weekend of the month. This year, the comparable period saw an even steeper increase. Consumers appear to have started their gift buying later than they did in 2021, possibly hoping to balance early discounts with the potential for inflation-driven price hikes.

- Target’s October Deal Days event, which ran Oct. 6-8, attracted nearly 28% more average daily visits from customers to Target locations than last year, and nearly 57% more daily visitors per store than in 2020. This data suggests that branded events such as Deal Days will bring holiday shoppers to stores. This bodes well for retailers such as Walmart that are offering Black Friday style discount days throughout November in addition to Black Friday weekend.

What Shoppers Are Buying

Shoppers are looking for deals, and they are willing to trade down for less expensive products amid economic headwinds.

The Wall Street Journal reports that shoppers are foregoing pricier items such as Lululemon leggings in favor of less expensive house brands they can find at places such as Target and Uniqlo. Luxury items such as expensive jewelry and designer handbags are less appealing, and when shoppers do opt for jewelry, they’re more likely to buy silver than gold.

JCPenney and Kohl’s told The Wall Street Journal they are seeing consumers switch to private-label brands, which tend to be more affordable than national brands. Ralph Lauren button-down shirts are out. Less expensive house brands such as Kirkland from Costco are in – for now.

According to 84.51°, Kroger’s retail and data insights company, consumers will be less brand-loyal this holiday season, continuing a trend that has correlated with ongoing inflation. Over half of those surveyed (57%) said they are looking for sales, deals, and coupons to use this holiday season, and 45% of shoppers feel they don’t need to buy a specific brand. As for the holiday side dishes, most consumers say they plan to make them from scratch, providing an opportunity for retailers to promote their private label pantry products.

Generally speaking, chains such as Target and Walmart and discount stores such as Five Below and Dollar General should expect to see a particularly strong increase in foot traffic because they sell less costly products and house brands, according to Placer.ai.

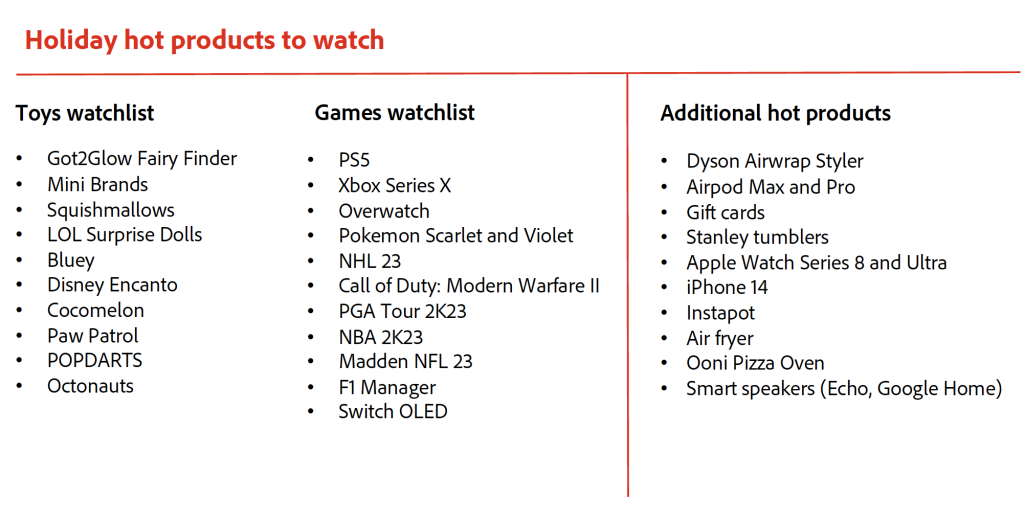

According to Adobe, the hot sellers this year will be pretty much the same as with previous years with toys, sporting goods, and holiday décor being popular categories although Adobe believes the electronics category will show an increase thanks to significant discounting. These products are on Adobe’s hot list:

How AI Can Help

AI can help both retailers and consumer packaged goods (CPG) firms in myriad ways amid the shifting sands of consumer preference and the return to brick-and-mortar stores. Here are two big roles for AI:

Keeping products on the shelf at the right time

One of the biggest challenges retailers and CPG firms together face is keeping on top of subtle shifts in buying behavior such as those cited in news reports.

Consumers want to save by seeking deals and by shopping for less expensive alternatives to name brands. But those behavioral shifts can differ dramatically by store and be affected by factors such as the weather. Effective AI can help retailers and CPG companies collaborate on demand forecasting down to the store level by crunching vast amounts of data quickly and feeding it back to retailers and their partners.

The key is to combine machine learning and third-party data such as search trends, social media chatter, and weather data to uncover real-time insight into clues about what consumers will do next. For instance, with real-time weather data, CPGs and retailers can plan in a more agile fashion as changes in weather patterns happen. They can also respond to unseasonal changes in weather such as unexpected cold fronts in warm-weather areas. Consumer search behavior and social media comments provide insight into searches for products with purchase intent.

No human being can keep track of all of that search activity, much less look for trends it reveals. With machine learning, CPGs and retailers can shift through it and find patterns and associations that would go undetected by manual means.

Machine learning is especially adept at finding nonlinear connections that are crucial for demand forecasting, such as the less obvious search behavior cited above, where the intent to purchase is not overt. Even an automated platform would have difficulty uncovering those nonlinear associations without machine learning. Machine learning and real-time data together can be a powerful one-two punch.

By reading real-time signals, retailers can be better prepared for major sales events such as Black Friday by forecasting demand for specific products from store to store.

To learn more about effective forecasting with AI, read our white paper.

Keeping Stores Safe and the Improving the Customer Experience

A spike in consumer traffic also means an increase in crime due to theft – and a potentially less pleasant experience overall as aisles become congested with shoppers.

But by applying AI-fueled behavior anomaly detection, retailers can keep stores as safe as possible and improve customer service at the same time.

Behavior anomaly detection consists of the use of computer vision and pattern recognition to keep stores safe, fight theft, and improve customer service. Behavior anomaly detection builds off computer vision, but it’s not the same thing. Computer vision is a form of artificial intelligence (AI) that makes it possible for computers to record visual data such as pictures and video. But computer vision only describes what is happening without meaningful interpretation of an event. Computer vision alone cannot capture the myriad and often subtle ways people behave. People with bad intentions, such as shoplifters, are constantly finding new ways to commit crimes, and computer vision alone does not evolve to keep pace with them. Nor is computer vision scalable for retailers that have traditionally used only point solutions for very specific applications. Computer vision needs pattern recognition to consistently detect behavioral anomalies, such as people in stores who are acting suspiciously. Computer vision describes what is happening; pattern recognition interprets what’s happening. But computer vision and pattern recognition together deliver true behavior anomaly detection.

This technology helps store managers keep stores safer by observing suspicious behaviors such as someone trying to distract an employee at the checkout lane, making multiple purchases, spending too much time going through store inventory, or slipping a product into their purse or overcoat.

Behavior anomaly detection can also improve customer service. For instance, behavior anomaly detection can alert a store associate about aisles or check-out lanes that are getting especially congested. The manager can act quickly to assign more store associates to address the issue (perhaps hot products are clustered too closely together, for instance). The technology might identify opportunities to help customers in many other ways, such as someone who might need assistance loading a large box of merchandise (and might be causing a bottleneck in a crowded aisle). Or perhaps too many store associates are clustered in one area of the store, missing opportunities to provide more complete throughout the entire space. With behavior anomaly detection, a store manager can ensure that store associates focus more of their time assisting customers and helping when someone might need special assistance.

To read more about the role behavior anomaly detection can play, read this post.

How Centific Can Help

Centific can help retailers in both the examples cited above.

For instance, our Scout offering incudes self-learning behavior anomaly detection. An integrated insights platform provides personalized and prescriptive analytics in real-time, intuitively alerting a store’s team to events before they escalate. Whether it's understanding a particular customer's behavior, detecting fraud at self-checkouts, or identifying on-premises hazards, Scout empowers retailers to act with confidence in real-time. Learn more about Scout here.

Meanwhile, our Meerkat offering can help retailers and CPGers collaborate on better forecasting and many other functions. Meerkat is our all-in-one demand, pricing, and promotions planning cloud platform, Meerkat gives retailers and CPG firms the ability to deliver the right product, at the right moment, and at the right price while simultaneously delivering financial value to their stakeholders. Learn more about Meerkat here.

Ready to talk about how we can help you? Contact us!