Four Trends Affecting the Consumer Packaged Goods Industry in 2023

The consumer packaged goods (CPG) industry is growing amid widespread disruption of the entire value chain, from the manufacturing floor to the grocery shelf.

Much of the disruption, such as the shortage of available labor in stores, falls outside the direct control of a CPG firm even though CPG companies are directly affected.

But amid disruption, a great deal of welcome change is occurring, such as the return of shoppers to stores. Here are four major trends affecting the future of the CPG industry in 2023, and a suggestion for how the design of human-centric, intelligent solutions can help.

1 Shoppers Continue to Return to Stores

Shoppers are returning to stores as we learn to live with the ebbs and flows of the pandemic – grocery shopping in particular. It’s likely that shoppers will continue to increase their in-person visits to stores as inflation and economic uncertainty compels them to cut costs, including home delivery fees associated with online shopping.

Forrester says that 72 percent of U.S. retail sales will still occur in brick-and-mortar stores in 2024. This is partly because shoppers (especially grocery shopping) remains a tactile experience.

But CPG brands need to plan for a multi-channel experience. Digital CPG sales are projected to account for approximately 10 percent of the U.S. CPG market this year — up from roughly 4 percent to 5 percent in 2019. CPG brands need to collaborate more closely with retailers to ensure that they can make their products available at the right price and time offline and online.

2 CPG Firms Collaborate with Retailers to Master Consumer Data

CPG companies and retailers together continue to be challenged by rapidly changing shift in consumer behavior, such as panic buying or shopping based on a trending social media topic.

CPG companies must focus more on the power of using data to resolve and/or prevent in-store availability issues. Gartner has reported that real-time visibility of accurate levels of stock availability across channels is crucial to achieving a high level of speed and accuracy in fulfillment execution.

But CPG companies cannot do so alone. Retailers and CPG companies are leaning into technology (that includes cloud-based platforms) to collaborate more closely on sharing retailers’ purchasing data that they need to know in order to do more accurate demand forecasting.

For example, Kroger recently rolled out a new tool, the 84.51° Collaborative Cloud, to help companies such as Conagra align production with demand across Kroger stores. This leads to improvements such as more efficient forecasting.

3 Retailers Continue to Grapple with a Labor Shortage

The retail industry continues to grapple with a shortage of labor. There simply are not enough store associates to fill key roles required to do everything from stock the shelves to service customers. There aren’t enough CPG retail execution teams to go from store to store in order to ensure their own products are properly shelved, promotional displays in place, and retail space fully optimized.

As a result, traditional in-store retail execution suffers from low store coverage, long in-store execution times, partial compliance, stockouts, and infrequent upsells. Retailers and CPG companies are missing opportunities to collaborate more effectively on activities such as planning promotions and demand forecasting.

According to Raleen Gagnon, vice president and general manager of total talent intelligence at Magnit, “The labor shortage isn’t going away for another few years. We just don’t have as many people entering the workforce as we do leaving it. While the high unemployment compensation during the pandemic has often been cited as the main reason driving the retail worker shortage, Gagnon said several longer-term trends are at play, including competition from warehouses and shifting priorities among younger workers.

On top of that, CPG firms face a labor shortage of their own -- as much as two times higher attrition in their frontline workforce than before the pandemic.

CPG firms are left with an open question: how to collaborate with retail firms to manage the retail experience with fewer people? The answer points to the use of shared data such as demand forecasting to empower retailers and CPG companies to do more with less.

4 Supply Chain Management Is Still a Challenge

We’ve all experienced the dysfunction of broken supply chains since the pandemic hit. Supply chains are beginning to loosen up and return to some level of normalcy, but they’re still very fragile and vulnerable to disruptions such as Covid-19 flare-ups (as witnessed in China). The bottom line is that CPG firms are still challenged to collaborate with retailers and fine-tune their inventory levels to match the vagaries of supply chains.

As a result, leading CPG companies continue to invest in AI-based supply chain management solutions that leverage business intelligence and artificial intelligence to give them visibility they need to ensure that their products are in stock – and that products are not overstocked.

Artificial intelligence (AI), combined with real-time data, will give savvier CPG firms what they need in order to fine-tune forecasting and planning to accommodate increased costs due to inflation. It also provides much-needed insight for brands looking to offer same-day delivery (and even shorter delivery windows) to maintain a competitive edge.

How Lighthouse Can Help CPG Firms Capitalize on These Trends

The above trends underscore just how important it is for CPG firms and retailers to collaborate with technology and data along the entire value chain.

At Centific, we believe technology can help retailers and CPG firms do even more together: specifically, with AI, retailers and CPG companies can deliver real-time insight on in-store operations. With that insight, they can make informed decisions faster and more accurately. This leads to more time devoted to customer-facing needs and more accurate inventory levels on the store floor.

Lighthouse consists of:

- An AI engine for understanding what’s on the shelf.

- A mobile app for information capture and the management of task lists for store associates.

- An insight business platform to support decision-making at the corporate office, which aligns strategic planning with in-store operations.

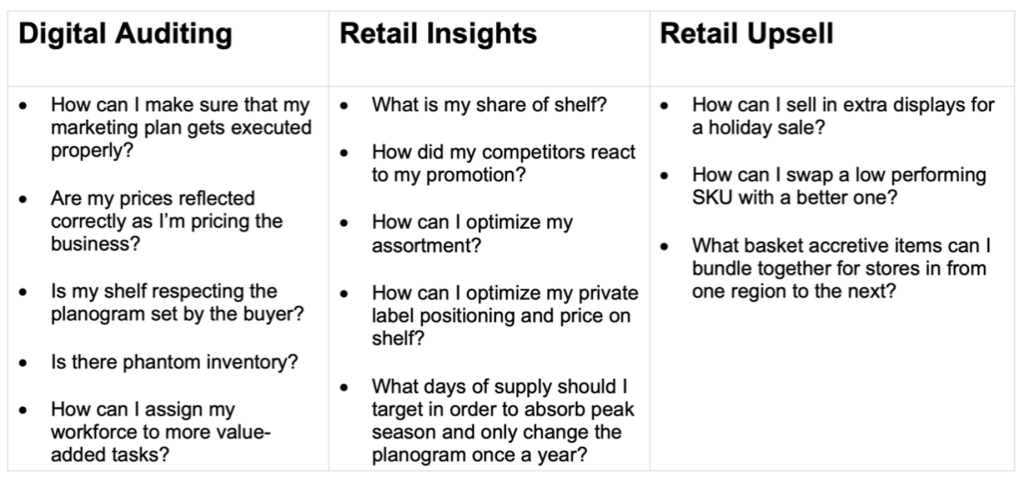

Lighthouse makes it possible for retailers and CPG firms to collaborate on answering questions such as:

A solution such as Lighthouse needs a combination of AI and humans in the loop to manage AI properly. For instance, a camera equipped with a computer vision model can analyze in store displays far more effectively than a human can. But computer vision needs to be trained with the right data to know that to monitor, and it needs to be updated as new products hit the shelves. Computer vision needs people to do that.

With the right combination of people and AI, retailers and CPG companies using a platform such as Lighthouse can deliver benefits such as:

- Optimizing inventory and store conversion: For instance, leverage mobile capture to not only detect out-of-stock items and phantom inventory, but to also trigger immediate replenishment activities.

- Anticipating and responding to changing conditions: for example, adapt sooner to emergent events by adapting your pricing, assortment, and inventory markdowns with store level precision.

- Bringing collaborators onboard in seconds: as an example, support the store with AI driven by an ensemble of models that ensure robustness, scalability, and accuracy for any in-store items.

We believe that AI guided by people will not only help retailers and CPG companies do more with less -- they’ll also thrive in ways that were not previously possible.

Contact Centific to get started.